Calculator Your Tax Return FY 23-24 Under New Tax Regime and Old Tax Regime

Anyone who has an income that crosses a specific threshold is required to pay taxes. Income Tax is the tax that is levied by the Central Government on the income earned during the financial year by individuals and businesses.

Union Budget Highlights 2023

On 1 Feb 2023 , our honourable Finance minister Nirmala Sitharaman presented her last full year budget of the Modi government.

Is It Important To Consult A Tax Professional?

We are living in an era of professionals, there are experts in every field to assist and guide a layman. For a taxpayer, filing taxes can be confusing.

Rectification Request In Orders Issued By CsIT

A request for rectification can be raised by an assessee if there is any mistake in the return filed.Once the return is filed then, an intimation is sent after an assessee has filed the ITR.

Income Tax Department Sends Notice To An Individual under section 143 (1)(a)

Income Tax Department sends notice to an individual under section 143 (1)(a) if there is any discrepancy while filing income tax returns, like less or excess tax is deposited, etc.

Is It Important To Comply With Tax Notices?

A tax notice is a written communication sent by the tax authorities to an assessee regarding any issue related to their tax return.

Have You Received Notice From The Tax Authorities?

It is time to welcome the new year and new beginnings with a bang. Inspite of filing your tax returns before the due date, you have received a notice from the Income tax authorities.

Income Tax slabs for sole proprietorship professionals partnership firms and companies for FY 2022-23 (AY 2023-24)

.jpg)

The income tax slabs under the old income tax regime for sole proprietorship businesses and professionals are same as salaried class.

Income Tax Slab: Good news! Income tax exemption for these people up to Rs 3 lakh

Budget 2023: Different slabs of income tax have been fixed in the country. In these, different tax rates are fixed on income in New Tax Regime, whereas in Old Tax Regime, different tax rates are fixed on income.

50000 Show Cause Notices Sent To Companies Partnership Firms After GST Audit

The goods and services tax (GST) authorities have issued around 50,000 show-cause notices (SCN) to several companies and partnership firms across sectors, including real estate and jewellery, following the findings of an audit exercise they started earlier this financial year.

Relaxation With Respect to Electronic Submission of Form 10F by ...

Partial relaxation with respect to electronic submission of Form 10F by select category of taxpayers in accordance with the DGIT (Systems) Notification No. 3 of 2022.

Senior and Super Senior Citizens may choose the Old Tax Regime or the New Tax Regime...

For income tax purposes, a resident is deemed to be a senior citizen if they had been 60 or older but under 80, whereas an individual resident who was 80 years of age or older at any point in the previous financial year is referred to as a super senior citizen.

Income Tax Department Sent Out A Fresh Warning For Taxpayers

The income tax department sent out a fresh warning for taxpayers who are yet to link their PAN with their Aadhaar. If the PAN is not linked with Aadhaar by the deadline then PAN will become inoperative.

Income Tax Department Gave Big Relief To Taxpayers Changed The Rules Of Tax Refund

The Income Tax Department has given relief to the taxpayers regarding refund adjustment against the outstanding tax. Tax officials will now have to take a decision in such cases within 21 days

Have You Missed Paying Advance Tax

Advance tax as the name suggests it is the tax paid much before the financial year ends. Famously, known as ‘ Pay as you earn’ tax also.In other words, an amount is paid to the Income Tax department according to the due dates given by them in the same year the income is received. By paying the taxes you not only act as a good citizen, but the new tax brackets are consumer-friendly.

e-Verification Through HDFC NetBanking

Follow Steps to e-Verify your income tax return Through HDFC NetBanking. Step 1 - Login to your HDFC NetBanking with your customer id and password. Step 2 - Look for “Enquire” and click – You can look for the same in your Account Dash Board.

How to Link AADHAAR with your PAN

With effective from 1st July, 2017 it is mandatory to link Aadhaar number with PAN.As per the Finance Bill 2017, all PAN applications will require the Aadhar card number to be mentioned and all PAN card-holders must ensure that their PAN cards are linked to Aadhaar card.

ITR packages prepaid online for Tax Professionals/ Reseller

ITR packages prepaid online for Tax Professionals/ Reseller. This includes Number Of Itr You Buy, Price Per ITR You Buy, Total In INR and STax @ 12.36% and Total Price In INR And Quotes on request please send email at reseller@taxmanager.in when Number Of Itr You Buy is more then 500.

The Rationale Behind The Income Tax Notices

Linking Aadhaar with PAN is a very good and tactical move by the government of India. Mentioning of PAN or Aadhar in all financial transactions by a common man is captured and updated with the Department of Income Tax which is keeping a track of all financial transactions with them

CTC Optimizer

CTC in simple words means the total salary package of the employee. It includes all the expenses spent by the company on the employee.

Income Tax Refund Status

Taxpayers who have filed their ITR before the deadline and are still in await of their ITR refund can find this long period of wait intimidating as almost 45 days have passed from the due date.

Revised Tax Returns

In simple words, you are filing your return again but with correct and complete information this time.

Tax Audit Circular

The Income tax authorities has extended the tax audit due date by 7 days till 7 October 2022. The circular stated

How To Pay Income Tax?

Income Tax is the tax paid by an individual and businesses on the income earned. The moment we discuss tax it sounds like a difficult task to be completed which we keep avoiding to be completed the last minute. The government of India has eased the burden and made it a hassle-free journey for a tax-payer.

How Do You Create A Financial Portfolio?

Confused, clueless about how to make a lucrative financial portfolio? Where to invest? We all would like our funds to build up for future goals and keep investing in different places that are the beginning of a financial portfolio.

Time To Knock The Doors Of A Financial Planner For Your Financial Well-Being FY 21-22

What is the reason that drives you to get up in the morning to your work? Or, What is the reason that you don't mind working late at night? Different needs drive an individual to work hard day and night. But the essential factor which wakes us up in the morning is our financial stability and growth.

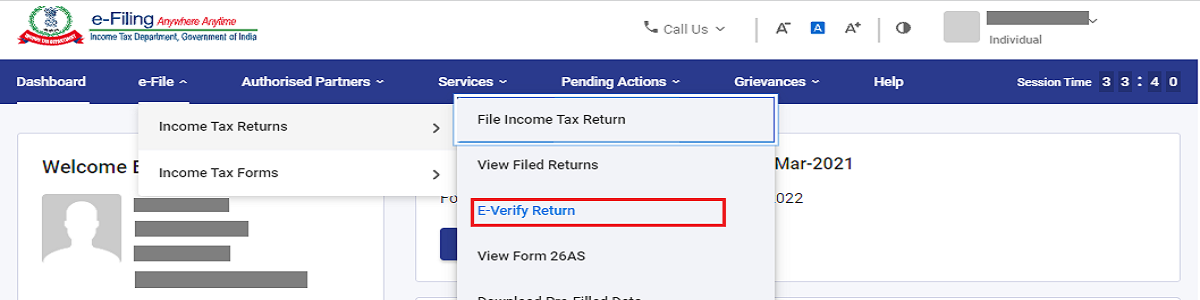

How to e-Verify Your Income Tax Return

After filing your income tax return, the next step is to verify it. The income tax department processes your return only if it is verified. Hence, you will receive refunds only if the return is submitted and verified. After successfully e-verifying your ITR, you don’t have to send the physical ITR-V.

Payment of Taxes Or Filing Your ITR- Duel Ends

As a responsible citizen of the country, one must follow some obligations and duties to enjoy this title unanimously. Paying your taxes on time and filing your returns as per the Income Tax authorities is a primary duty .

Complexity With Two Form 16’s

Form 16 is a mandatory certificate to be provided by the employer to the employee. It acts as proof of timely tax payments. It also shows how your taxes have been calculated depending on the declarations made at the beginning of the year regarding allowances like house rent or medical bills.

NRI Taxation

Non-resident Indians are residents who are earning income outside India. The rules and regulations are different for an NRI and an Indian citizen.

What Are The Due Dates For Filing Tax Returns?

Filing tax returns is a mandatory requirement if you fall under a specific income tax bracket. To ease the process the Income Tax department has set the last dates for filing returns for specified individuals without late fees under Section 139.

Is Filing Return Easier With A Professional Help?

We are living in an era of professionals, there are experts in every field to assist and guide a layman. For a taxpayer, filing taxes can be confusing and if left as a last-minute job it will be frustrating also.

How To Select The Relevant ITR Form?

The tax imposed by the government on the income of individuals, Hindu Undivided families, companies, firms, LLP, associations of persons, the body of individuals, local authority, and any other artificial juridical person.

Importance of tax deduction at the time tax planning

The tax deduction is a methodology followed to lower the tax liability of a taxpayer. The motive behind this technique is to build a habit of saving among people for a stable future. The technique used here is to set off all the expenses made in the form of investments against the gross annual income in a financial year.

Importance Of Form 16 And 16 A

A form which validates the arrival of tax submission time for an employee. Form 16 is the proof of filing the return of the employer to the income tax authorities.

How To Interpret Form 26AS While Filing Your Income Tax Return?

If you have taxable income and file your ITR then you must be familiar with Form 26AS. It is an annual statement that has a complete overview of tax deducted at source,

Changes In ITR Forms For The FY 2021-22

At the onset of the budget every year there are changes brought about in the taxation provisions. For Fy 2021-22 there are no changes given in the income tax slab rates and small changes in the return forms,

Are the Financial Planning And Tax Planning Sides Of The Same Coin

As a layman or a person going about their business during the day the tax planning and financial planning would seem like two different terms. To a certain extent, it is the truth,

Things to prepare before filing the Tax returns

Being a responsible citizen of the country, it is important to pay taxes on time. The last day of filing the tax return for an individual is 31 July

Crypto World And Regulations By The Indian Government

The Crypto world crept into Indian households silently but very effectively. Its non-recognition for a very long time by the government did hamper its progress in our society but not anymore.

How To Make Your Income Tax-Free Even After Earning Rs. 10 Lakh In FY 2022-23?

An individual needs to pay taxes on time but there is always hope of taking maximum salary back home. A smart taxpayer should understand the provisions given under the New Tax Regime to avail of its maximum benefit.. .

The Rationale Behind The Income Tax Notices For High- Value Transactions

At the start of the new financial year many of the tax assessees have received the High-Value Transaction Notices from the Department of Income Tax – Why would they receive this and what do they need to do to comply.

Can You Make Your Salary More Tax Efficient In The AY 2023-24?

Salary is the compensation you receive as an employee after hard days of work at the end of the month. The prospect of discussing our salary is a scare for most of us, as we do not understand how to plan to spend our earnings wisely..

How To Use Income Tax Calculator Easily Online For FY 2022-23?

The only thing that hurts more than paying an Income Tax is not having to pay an Income Tax” as stated by a famous author Thomas Dewar. .

Few Important things to be done before 31st March

As we have entered the month of March the countdown to the end of this Financial Year 2021-22 has begun. 31st March is the . .

Save Taxes The Right Way- Investment And Tax Savings

One obligation any individual would happily like to undertake is paying higher taxes if your income bracket has increased. . .

Guess The Winner- RENT OR EMI?

Confused minds lead us to explore big possibilities. Life is like a multiple-choice question,sometimes the choices confuse you, .

Is It Possible To File Tax Return Even After Missing The Deadline?

Being responsible citizens, we all try to pay taxes on time. To err is human so any unforeseen circumstances in life may lead to our failure of filing tax returns on time. If an assessee fails to file his Income Tax Return before the due date, then as per section 139(4) of the Income Tax Act 1961, then they can file . .

It’s time to clear your advance tax liability

You may agree that paying taxes is the most annoying part of earning and financial growth, the more you earn the bigger the amount of tax outgo. But the good part is that the tax you pay to the government is used for various purposes like infrastructure development, maintenance of public facilities, social good, . .