- IN THE NEWS X

- It’s time to clear your advance tax liability

- Seniors need to submit Forms 12BBA, 15G, 15H to save on TDS: Experts

- How investing in 54EC bonds can help you save tax on long-term gains

- New income tax forms are out for new assessment year 2022-23. Find out which one you should use

- New ITR forms need income disclosure from foreign retirement a/cs

- Why is March 31 an important date for taxpayers? Find out

- Not filed ITR yet? Face penalty or even jail term, say analysts

- March 15 Is The Last Date To Pay Advance Tax: Time To Clear Your Liability

- It's time to deduct TDS if rent exceeds Rs 50,000, say analysts

- Clarification on capital gains tax on early redemption of Sovereign Gold Bonds is required – Here’s why

- Second amendment to LLP Rules will ease procedural burden: Experts

- Three Things To Keep In Mind Before Investing In RBI’s Sovereign Gold Bonds

- Tackle low liquidity in sovereign gold bonds by laddering, say analysts

- CBDT, tax tools make e-filing of I-T returns simpler

e-Verification Through HDFC NetBanking

Written by Gagandeep Arora - Printed on - Date - 25th Nov 2022

Follow Steps to e-Verify your income tax return Through HDFC NetBanking.

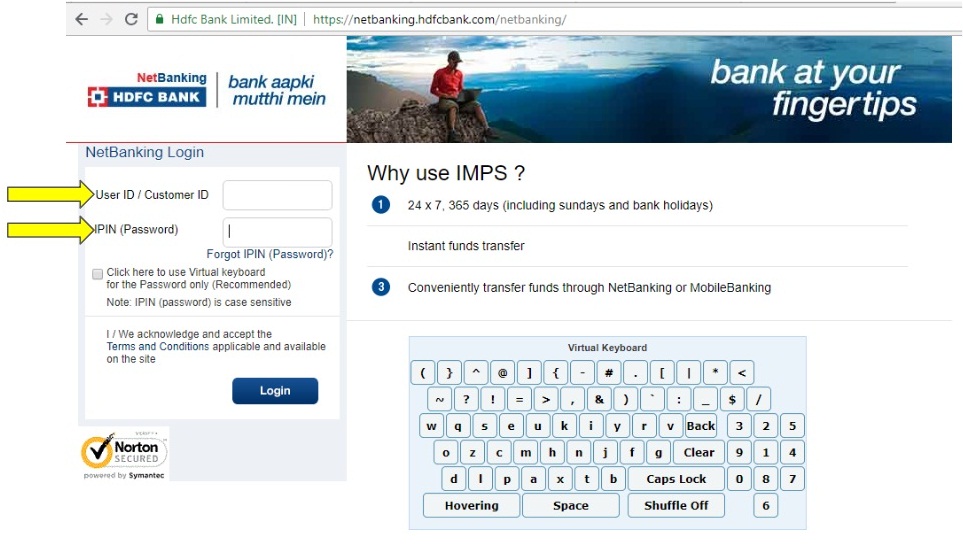

1. Login to your HDFC NetBanking with your customer id and password

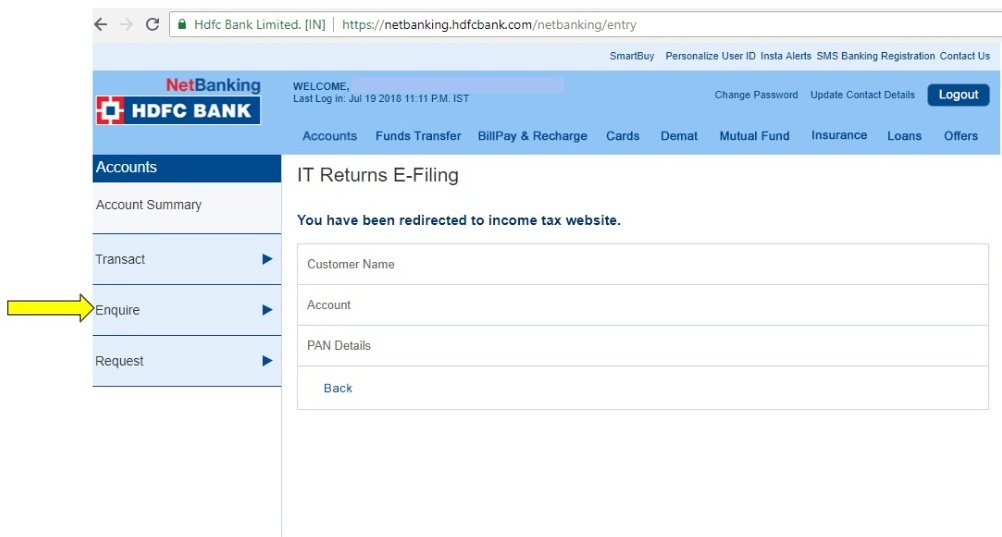

2. Look for “Enquire” and click – You can look for the same in your Account Dash Board

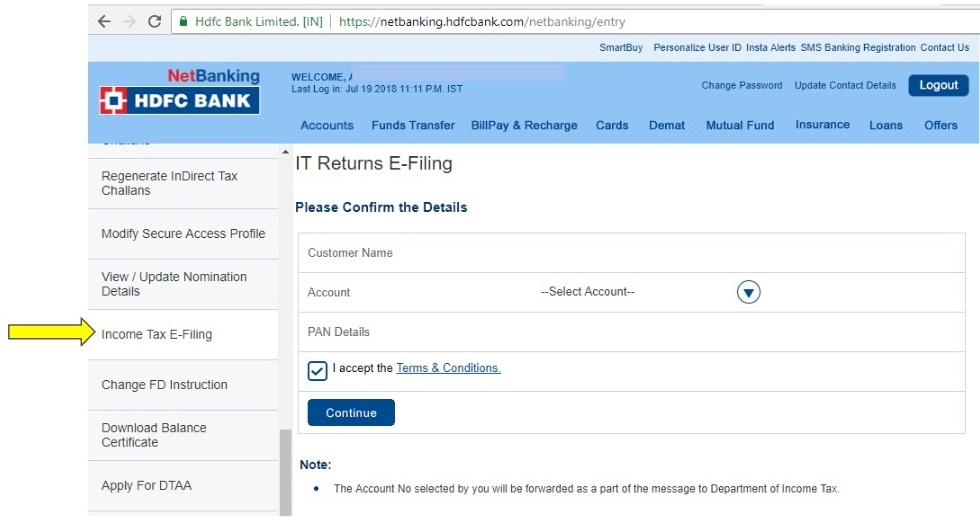

3. Look for “Income Tax E-Filing” and Click and then Accept “Terms and Conditions”

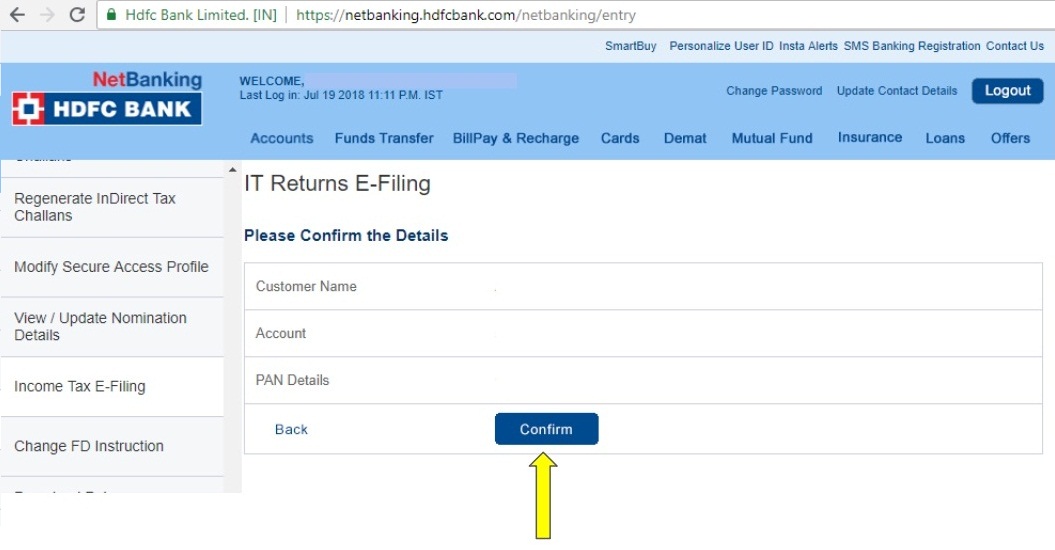

4. Click on Confirm and it will redirect your Income Tax E-Filing Website

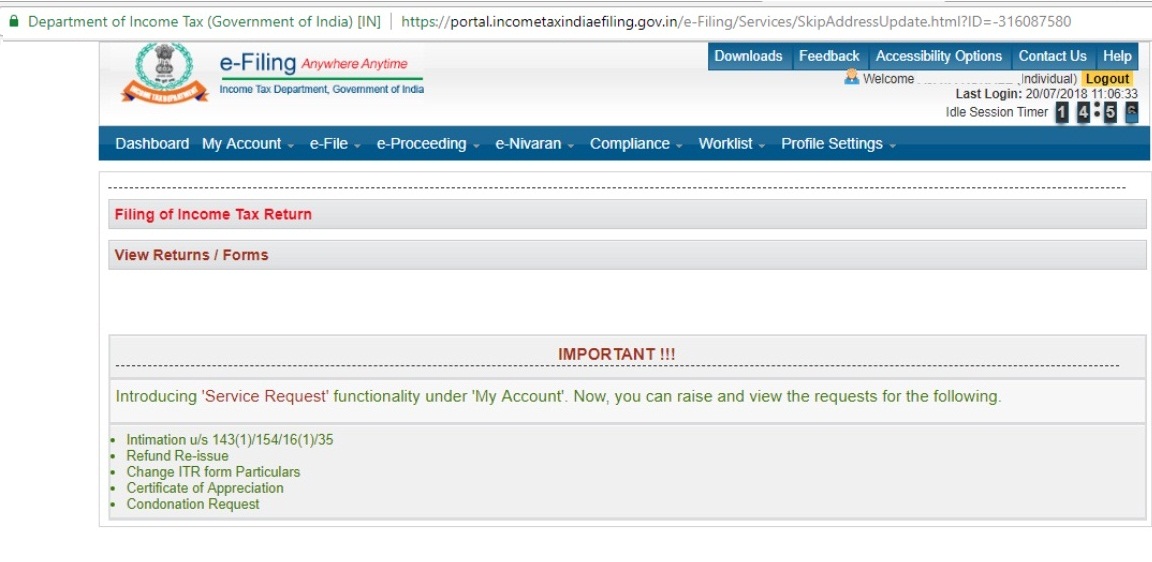

5. Click on My Account on the Dash board and Look for e-Verify Return in Drop down

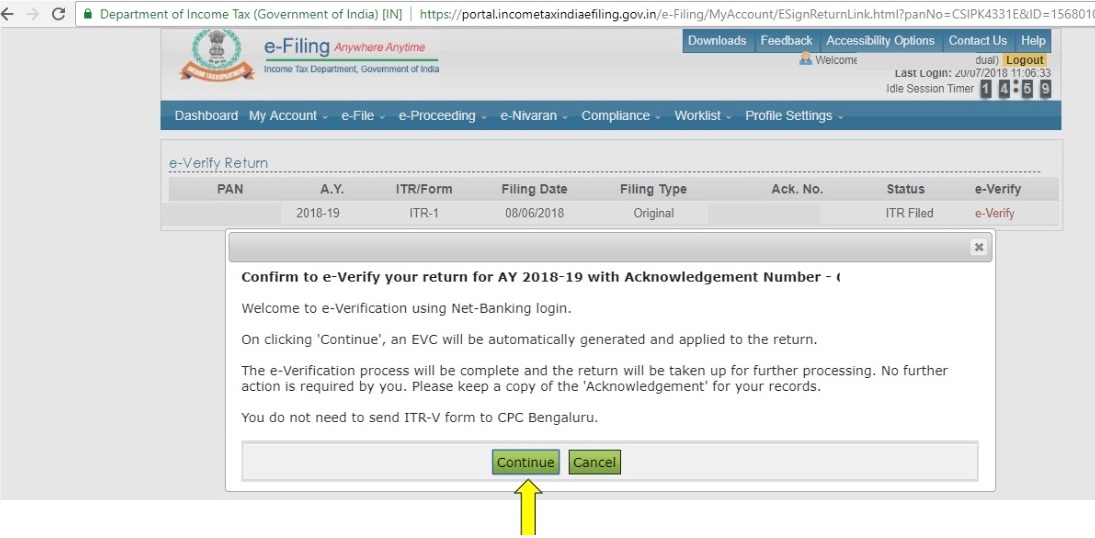

6. Click on the e-Verify on the right hand side of the income tax return filed and to be

e-verified

7. Click on Continue to e-verify

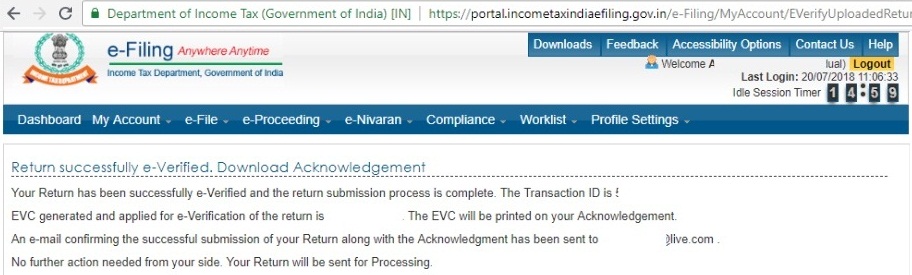

8. You will get a confirmation message for successful e-verification with mail

confirmation

You have now successfully e-verified your income tax return.

Thanks for choosing TaxManager.in as your Trusted Tax Partner.

You may login to your account with www.TaxManager.in/Login/Login.aspx or Call us

at

+919555331122